It's 2040.

The American President has just been elected for a second term. She won as a third-party candidate as a result of the reforms to the electoral college in the 2030s that finally broke the stranglehold of the two-party system. While her platform for addressing climate change and disaster support for parts of East Coast cities that are now underwater was supported by most Americans, it was her policies around the New Longevity Deal that gave her the landslide win.

Much like landmark policy movements of the past such as the New Deal, The Great Society, and the Inflation Reduction Act, the New Longevity Deal ushered in changes that in this case impacted the rapidly aging American population. Nearly half of the country’s citizens are in their forties or older. One in five Americans, nearly 80 million, are 65 and over. By 2060, it is anticipated that over 90 million Americans will be 65 or over, including the Millennials. Life expectancies are growing, too. There are already several hundred thousand Americans who are 100 years old or older, and that number will grow to more than 3 million by 2100. This expanded voting bloc of the older population has had a profound effect on both elections and federal legislation.

The New Longevity Deal has addressed issues with Social Security and Medicare benefits, leading to new governmental policies to enhance healthcare and a social net for aging citizens. It provides massive re-training programs for people over 50, as well as creating a new Job Corps for those over 65 to allow them to continue to earn an income. There are 44 million people over 75 who both need and want to work, especially as they prepare for longer lives. Federal laws have been put in place to require every employer to provide a 401(k) type program to prepare people for long term economic stability and penalties have been established for any company that has mandatory retirement age policies. Tax incentives have been introduced for older workers staying on longer in the workplace, as well as incentives for employers who hire older workers. In addition, new models of public-private partnerships and nonprofit organizations are in place to enhance ways to support older Americans, particularly those in low-income areas.

The Deal has provided tax credits, incentives, and low interest loans for companies that have a focus on products and services are that targeted to an older population—particularly those focused on technology, mobility, and medical advancements for longer, healthy living. A new Cabinet of Longevity has been created by the Administration to oversee the government’s involvement. Inspired in part by the Singapore government’s policy efforts on “The Future of Aging,” the U.S has now studied the 70 initiatives from that approach to see what can be adapted to American society.

It has all been the byproduct of the social movement that started in the mid 2020s, as the Boomers began to challenge how older people were being ignored by government and business and how they’ve been portrayed in entertainment and marketing. As they continue to vote at the polls and with their dollars, they reject candidates and brands that ignore the needs of older Americans and have outdated images of over-50 people in their advertising. Instead, they support new brands that have been created to attract the new wave of older Americans who remain fit, tech-savvy, vital, and involved. The Baby Boomers were the original activists that embraced civil rights, the women's movement, Earth Day, and more. In the 2020s, they took up their next cause—challenging all notions of aging, not just for them but for the following generations.

In the 2040 workplace there has been a massive movement to retain, retrain, and redeploy employee talent over 60. It’s not unusual for 70-year-olds to be leading intergenerational initiatives, especially as most companies refocus on the needs of aging consumers and find themselves in talent wars for seasoned, experienced employees who understand the shifting landscape. A hot new executive search firm that has aligned itself with the new breed of management has led the charge to break down the old-fashioned idea that people over 60 are not employable.

The aging-at-home movement is also in full swing in 2040, enabled by advances in technology, telemedicine, and in-home medical care. The traditional nursing home model has become obsolete, as new types of housing and communities for both the affluent and for the average citizen have emerged to accommodate the fast-growing in-home medical care industry, along with the advances being made in medicine like the vascular capsule endoscopy that can monitor clots and tears in the blood vessels.

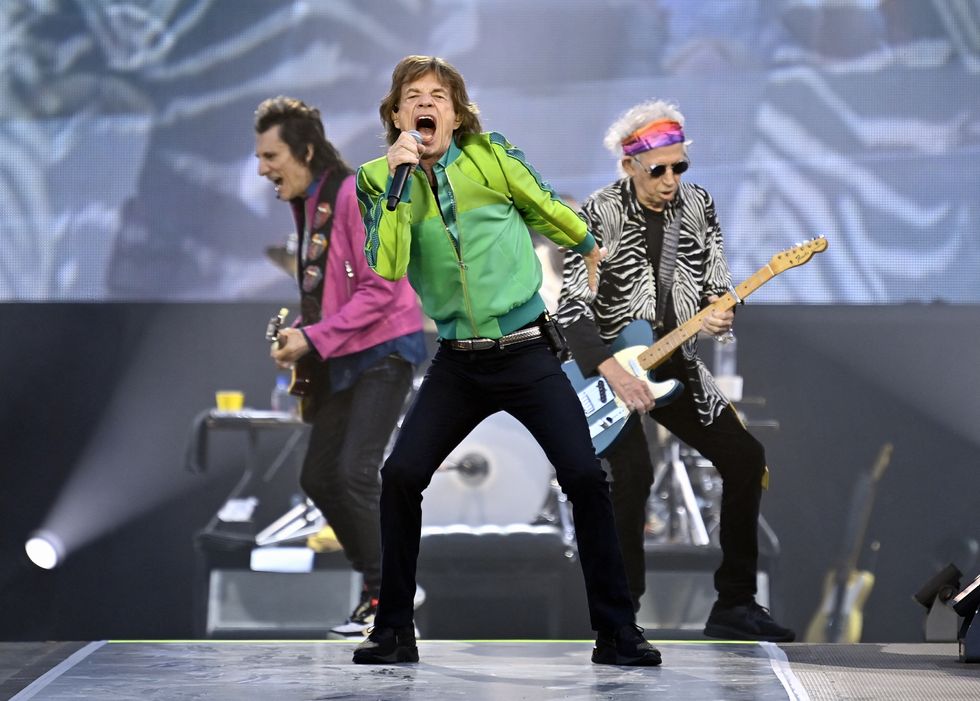

Throughout the sports, entertainment and music worlds, aspects of the New Longevity are playing out in the culture. The NFL has a star quarterback who is 50, a 44-year-old female Olympian has broken the record for being the oldest U.S. woman to win a gold medal in track, and the Rolling Stones are still together, hoping to be the first 100-year-old rock band on tour. Fashion and luxury companies have realized that using 25-year-old models doesn't appeal to the 50-plus consumer base that controls more than $10 trillion dollars in spending. While younger, emerging talent influences trends in culture, so do vibrant over-50 entrepreneurs who are driving innovation across industries from movies to virtual living.

The metaverse is in its 4.0 stage and it has opened up a world of previously unimaginable experiences: People are able to join a live, virtual concert that will have a global audience, experience skiing down virtual trails that feel as real as those in the Rocky Mountains, and allow friends in New York and Perth to meet up in hologram form to have dinner together. Social isolation and loneliness have been addressed through many of the new metaverse offerings.

Sound implausible? It's all more possible than you think.

According to Bradley Schurman, author of The Super Age: Decoding Our Demographic Destiny, we are on the cusp of major shifts that will impact how we live, work, and love. While the Boomers will be 76 to 94 years old in 2040, Gen X will be 60 to 75, the Millennials will be 44 to 59 and even the first Gen Z'ers will be in their forties. The whole country will be rapidly moving into the second half of their lives with expectations to live to be 90 or older. Assuming static birth rates and limits on immigration, this will create profound changes and expectations within society, not just in the United States, but with most advanced, Westernized countries.

There are already many engaged in what our world will look like as we evolve on this front. Think tanks, venture funds, businesses, and government initiatives are all looking at what a different future might be like and how we prepare for it.

The concept of retirement is already being challenged. It's a model that was created in the 1930s to move older people out of the workforce. Combined with the Social Security Act, it worked well. But life expectancies at the time were in the early 60s. Today and certainly in the next decades, retirement as we know it will become an obsolete idea. Retiring at 65 when you may have another 25 years or more to live will require a complete rethink, as people will want to rewire and have newfound purpose in their lives.

Work will take on different forms for this group. According to Kerry Hannon, work futurist and author of In Control at 50+, there will be all kinds of new models that will require a redeploying of skills. That means, for instance, lifelong learning initiatives for older workers to keep pace with changes and the emergence of new kinds of jobs that will “ride the age wave” in growth sectors such as senior concierge services, health and fitness, and more. As the college-age population decreases, universities that are already in the business of continuing education and schools of professional studies for specialized degrees and certificates can play a major role in helping current and next generations to be upskilled to work longer and better.

Elatia Abate, who consults in the future of work and leadership, explains that the “mosaic ladder” of building a career vs. the traditional career ladder will play well for an aging population. It will allow seasoned, experienced people to tap into their core talents that can plug into a company’s needs. This wouldn’t require someone to be a full-time employee, but rather working on multiple projects for multiple companies, participating in healthcare pools for their insurance needs. The anticipated growth of remote work options will add to the flexibility for older workers, as they avoid the physical toll of commuting, leaning into their mental acuity and knowledge to continue to contribute.

Companies will also have to create new policies to accommodate an aging workforce. According to Emilia Morano-Williams, a senior editor at Stylus, a trends and insights company, firms like Thinkerbell are already offering over-55 internship programs. Fitness company P.volve, offers fitness classes as a workplace benefit, including Moving with Menopause for an aging employee base. It’s not inconceivable that the benefit scales will tip away from childcare and more to eldercare in upcoming decades.

What are some of the other ways in which we might see change that will set us up for a new future?

There’ve been many reports that caution that the Social Security Trust Fund 's reserves will be depleted in 2034, leading to a reduction in payment benefits to those on the Social Security rolls unless some legislative action is taken. The fact is that the system itself will continue based on ongoing payroll taxes. But with more Americans collecting social security, especially as the boomers leave the workforce and there are fewer people paying into the system, a reduced payment would have a big impact on individuals and couples. The Social Security Administration reports that at least half of the income of 50 percent of elderly married couples rely on social security as a main source of income. According to some experts, there will have to be new ways to shore up social security, while also continuing to work on making people realize that they have to take control of their own economic futures, especially as they continue to live longer.

Between now and 2034, there are multiple decisions that need to be made. Congress must either increase payroll taxes or once again increase the age for full retirement eligibility from what is now 67 years old. One leader of a national think tank suggests that we may have to find other sources of income to augment social security benefits. This might include state or local programs for older people, government sponsored annuities that are deferred payout until someone reaches 80 years old, or new programs that encourage foundations, particularly geographic centric ones to create programs that help to augment income of aging citizens.

Others suggest that reducing the Cost of Living Adjustment now in the social security system would help, while others suggest not taxing social security payments for those couples below the annual $44,000 income threshold would help to keep more money in the pockets of those facing financial hardship.

But all of these are Band-Aids to the bigger issue of a rapidly aging population. What is really needed is a societal shift to a universal retirement savings mechanism to make people aware that they will need more than social security to fund a life that could reach 90 or longer.

At the Georgetown Center for Retirement Initiatives, executive director and research professor Angela Antonelli focuses on the importance of building a lifetime of income. At the moment, there are an estimated 57 million workers in the private sector that have no access to programs like 401(k)s. Requiring employers at a state level to provide such programs has been one of the initiatives that the center is involved in, providing guidance on model legislation. So far, 16 states have adopted the Auto IRA model that the Center advocates. The programs are public private partnerships with the state and private sector helping to build what Antonelli calls a "culture of savings" for younger people.

Other groups like The Alliance for Lifetime Income, a 501(c)(6) educational program are focused on this effort. Jean Chatzky, founder of Her Money and a fellow of the Alliance, has written AgeProof: Living Longer Without Running Out of Money or Breaking a Hip with Dr. Michael Roizen to put a focus on the effort. A New Longevity Deal might help create federal programs, underscoring the need for other savings programs aside from Social Security for the well-being of future generations.

The potential solutions don’t stop there. Cindy M. Lott, a clinical professor and Director of the new Professional Doctorate of Philanthropic Leadership at Indiana University believes that government may need to enlarge the universe of incentives for philanthropic organizations to focus on the specific needs of a demographic “bulge” of an aging population. For example, Lott sees a potential role for philanthropic organizations to step in as partners with government to help with elder housing, having people be paid and subsidized for caregiving efforts to augment incomes or to allow people who volunteer in the nonprofit sector to have a tax deduction based on donated time.

That sentiment is echoed by Erwin de Leon, chief diversity officer and faculty member at the Columbia University of Professional Studies. He believes that foundations that can play a dynamic role in advocacy with government and public policy. De Leon points out that minority groups such as LGBTQ seniors or members of the API community are often the most who struggle as they age. "The New York City Chinese community is the poorest in the city. With longevity trends, that community will need assistance in housing, health care and social needs, " he explains.

Another idea in a New Longevity Deal would be to include a federally funded effort to provide a "bubble" payment to any citizen over 80 that can help to prevent elderly poverty, as well as other public private partnerships that might create funds for those 80-and-abovers to pay for housing, medical and everyday needs.

With people working longer, older Americans will continue to pay meaningful federal taxes which could help to fund this idea. One study showed that federal taxes from those over 50 will quadruple between 2018 and 2050, with meaningful increases on the state and local level, as well.

Also, with the largest generational transfer of wealth in the history of the world about to take place over the next 20 years or more—an estimated $60 to $70 trillion dollars in assets—how can those more fortunate focus on social impact efforts that aid an aging population? An existing foundation could take this on as a core mission or an aging boomer might start a new foundation that focuses on the needs of older people. Putting some of these assets to work in this area should become an important philanthropic mission.

In the business sector, there are already a number of initiatives that are future-focused on addressing the needs of older adults. Primetime Partners, founded by longtime venture capitalist Alan Patricof (an octogenarian himself) and his partner Abby Levy, is an early-stage venture capital fund that invests in products, services and experiences in the underserved global sector of aging. The fund already has 25 investments, one third of them led by entrepreneurs over 50. One of them is Tembo Health, which provides mental health telemedicine for people in senior living facilities, as well as a solution for primary urgent care that avoids calls to family members or 911.

Another venture backed by Primetime is Cenegenics, a growing network of 22 longevity clinics. They take a holistic and individualistic approach to physical and mental health, all backed by technology, data, and metabolic science.

According to Patricof, these companies represent the beginning of a wave of businesses that will emerge to address a changing world. Eldercare and home health care startups such as DispatchHealth and Wellthy are two other examples that are gaining momentum.

Imagine a day when medical advancements allow for continuous glucose monitors from home, dementia medication to detangle and de-plaque your brain, pharmaceuticals that slow down the aging process, and exoskeletons that allow for better mobility as we gain in years.

As we push past 100 into what some scientists say will be the 150-year life someday, the healthcare-meets-technology world will have an explosion of growth for entrepreneurs and businesses. Dr. Laura Carstensen, Director of the Stanford University Center for Longevity, who led the charge for the New Map of Life initiative which points out that the 100- year life is already here says, “The most exciting area in basic science today is Geroscience. Because aging itself is the greatest risk factor for disease, understanding the underlying mechanisms can increase health spans.”

Carstensen explains that there is a lot happening in the areas of microbiome, parabiosis, and studies around caloric restrictions as we age that may help us live longer and healthier lives.

Dr. Adam Stracher, Chief Medical Officer of Weill Cornell Medicine explains that a lot is on the horizon with our primary care doctors. While telemedicine accounts for up to 20 percent of Weill Cornell’s primary care visits now, with the right infrastructure that proportion could grow significantly, according to him.

Explains Stracher: “More advanced and sophisticated devices are being developed for in home testing from blood pressure to continuous glucose monitoring, to point-of-care blood testing, as well as diagnostics to identify strep throat, flu, COVID, and other infectious diseases in the comfort of one’s home. What needs to happen is these technologies need to be more seamlessly integrated into existing health care systems.”

Earlier this year, Saudi Arabia announced plans to invest $1 billion a year to discover treatments to slow the aging process. The vehicle for this effort is a non-profit called the Hevolution Foundation which will focus on research on the biology of aging and underwrite studies on potential anti-aging drugs.

Property developers are also beginning to focus on new types of housing and alternatives to current nursing home models, as well as initiatives to improve aging at home. New York based Atria properties has just opened a new high end senior living complex with 126 units called Coterie Hudson Yards with high end design features, technology-infused Alexa smart home systems, and restaurant menus designed by the Mayo Clinic.

According to Joanna Mansfield, general manager of Coterie, there are dedicated individuals to help with healthcare issues, including Solis Health Concierge services on site and telemedicine capabilities. In addition, there is a staff of 40 that can help with entertainment and lifestyle needs for residents. For those who have special medical needs and medications, there are discrete locations and individualized services on each floor, as well as a Memory Care floor of apartments with added capabilities. It’s a new model that will redefine the stages from independent living to assisted care.

There are plans to replicate Coterie in other affluent communities like West Palm Beach and Cupertino.

Another real estate effort aimed at the active-aging cohort is the Kallimos Communities, a concept that is multi-generational housing created in pocket neighborhoods, allowing older people to interact with younger generations, all facilitated by a “weaver,” whose role is to foster a sense of shared community.

Schurman’s The SuperAge company has developed SAID, a Super Age Inclusive Design Certification that will help both residential and commercial developers to incorporate better accessible guidelines, particularly as the population ages. “How can we improve on places like bathrooms, lighting and other basics to make business more attuned to the needs of older people who want to age at home, particularly since we will all acquire some form of disability as we age? These efforts will also help people of all ages who may have a chronic or acquired disability. That’s what we want to help solve for,” says Schulman.

New consumer brands such as CADDIS, founded in 2018 by serial entrepreneur Tim Parr, is another example of how businesses are emerging to address the needs of an older demographic. Eyewear glasses is their product, but their stated mission is to “call out the whole Fountain of Youth illusion, industries that profit from the fear of getting older and the concept of “aging gracefully.”

According to Parr, the designs start with classic or timeless styles and then builds into the user’s identity, which is more contemporary. When you look on their website, a mix of created and user-generated photography showcase people over 50 who represent what is the new image of that group. CADDIS is bringing cool to filling a need that everyone who gets older will have—a pair of reading glasses.

In the marketing, media, and entertainment worlds, there will be a major reckoning in how to pivot to address what is the rapidly changing demographics of the consumers who will drive brands and engage in culture.

Representation of people over 50 in ad campaigns and in television and movies continues to be grossly outdated. There are some sprouts emerging, however. The Netflix series Frankie and Grace was wildly popular and Emma Thompson broke new ground recently in the movie Good Luck to You, Leo Grande, about a retired widow who hires a young, male sex worker.

One of the smarter moves has been made by MRC Film with the launch of Landline Pictures, established in 2020 to create feature films and series for an over-50 audience.

Amy Baer, a seasoned Hollywood executive who is President of the company explains that it’s a segment that is massively neglected. “Our approach is aspirational, inspirational and life affirming projects for viewers who don’t see age other than life experiences,” she says.

In 2022, the studio launched Jerry and Marge Go Large with Bryan Cranston and Annette Bening and it debuted on Paramount Plus at No. 1 for subscribers. A new Renee Zellweger film, Back Nine, will be released in 2023 with another 15 projects in the works. According to Baer, content for older audiences has been one of the top requests from distributors.

One of the challenges continues to be new ways to target the new 50-plus audience with new media buying strategies. As one former CEO of a major advertising agency says, “The default position to reach people over 50 has always been through syndication of old television series or the evening news which has an older viewer.”

Bill Koenigsberg, CEO and Founder of Horizon Media, one of the largest media buying companies in the country is more optimistic about new ways to target the changing older consumer. “Ten years ago it was all about demographics,” he says. “But now we have actual buying and behavior data to help us understand consumers better. We can see that consumers over 55 are very different today. Smarter marketers are looking at that shift, as people live and work longer and spend differently.”

Throughout the media and agency world, there is an acknowledgement that Boomers, who account for trillions of dollars in spending power, are no longer brand loyal. They spend heavily on technology, cars, travel, home products, and more, and yet they’re largely ignored as targets for brand messaging.

In a recent Los Angeles magazine article, “In With the Olds! Why Aging is No Longer a Dirty Word,” writer Benjamin Svetkey points out that there is still a long way to go. He states that Nielsen statistics show that only 5 percent of advertising is directed at people over 50 and only 10 percent of TV shows feature older characters with speaking parts, despite the fact that the average viewer’s age even at a “youth-skewing” network like the CW is 58.3 years old.

In 2022, A&E Networks conducted a study with Amazon and an artificial intelligence tool to look at 20,000 television commercials. Only 1 in 10 included a face over 50 and only 1 in 25 included a woman over 50. Most of them included those people in passive, downbeat scenarios.

Luxury advertisers are the worst offenders. In more than 25 advertising campaigns from these brands in the spring of 2022, only one, Dolce and Gabbana, featured a model over 30, and that was 64-year-old Sharon Stone. There is an assumption that a 55-year-old affluent woman who can afford their products is obsessed with the 25-year-old influencer that’s in their campaigns. It’s an obsolete approach.

No one is suggesting that marketers shouldn’t cultivate the next generation of consumers. However, ignoring the huge population bulge of older demographics is to ignore at one’s peril. Age diversity is as relevant as race and gender, especially since it affects everyone regardless of their background.

It’s shocking how far behind the marketing and media world is with regards to keeping pace with the dynamic growth of the 50 and older consumer who is reshaping the purchasing landscape. As one industry observer put it, for an industry that prides itself on being forward thinking, they are completely backwards with regards to this phenomenon. Some people say that it is due to the inherent ageism within those worlds, especially the agency world, where hitting 40 is considered over the hill and no creative people over 50 who produce advertising actually have a seat at the table.

The year 2040 is 18 years away and there will be many advancements between now and then—plenty of which we can’t even imagine.

But what we do know is that we will be a society with dramatically new needs, wants, and demands based on people living longer lives and remaining productive. The sheer numbers of those over 50 will reshape everything from government policy to business to culture itself. The age tsunami is bearing down on us. The question is: Will we be ready to ride it?

Michael Clinton is the special media advisor to the CEO of the Hearst Corporation and author of ROAR into the second half of your life.